CRM for investment is transforming the way investment firms manage client relationships, streamline processes, and enhance overall investment outcomes. This innovative technology empowers investment professionals with powerful tools to nurture client connections, automate tasks, and gain valuable insights that drive better decision-making.

By integrating a CRM system specifically tailored for investment management, firms can gain a competitive edge by enhancing client experiences, improving operational efficiency, and maximizing investment returns. Let’s delve into the benefits, key features, best practices, and future trends of CRM for investment management.

Benefits of CRM for Investment Management

CRM systems designed for investment management offer several advantages, streamlining processes and enhancing client relationships.

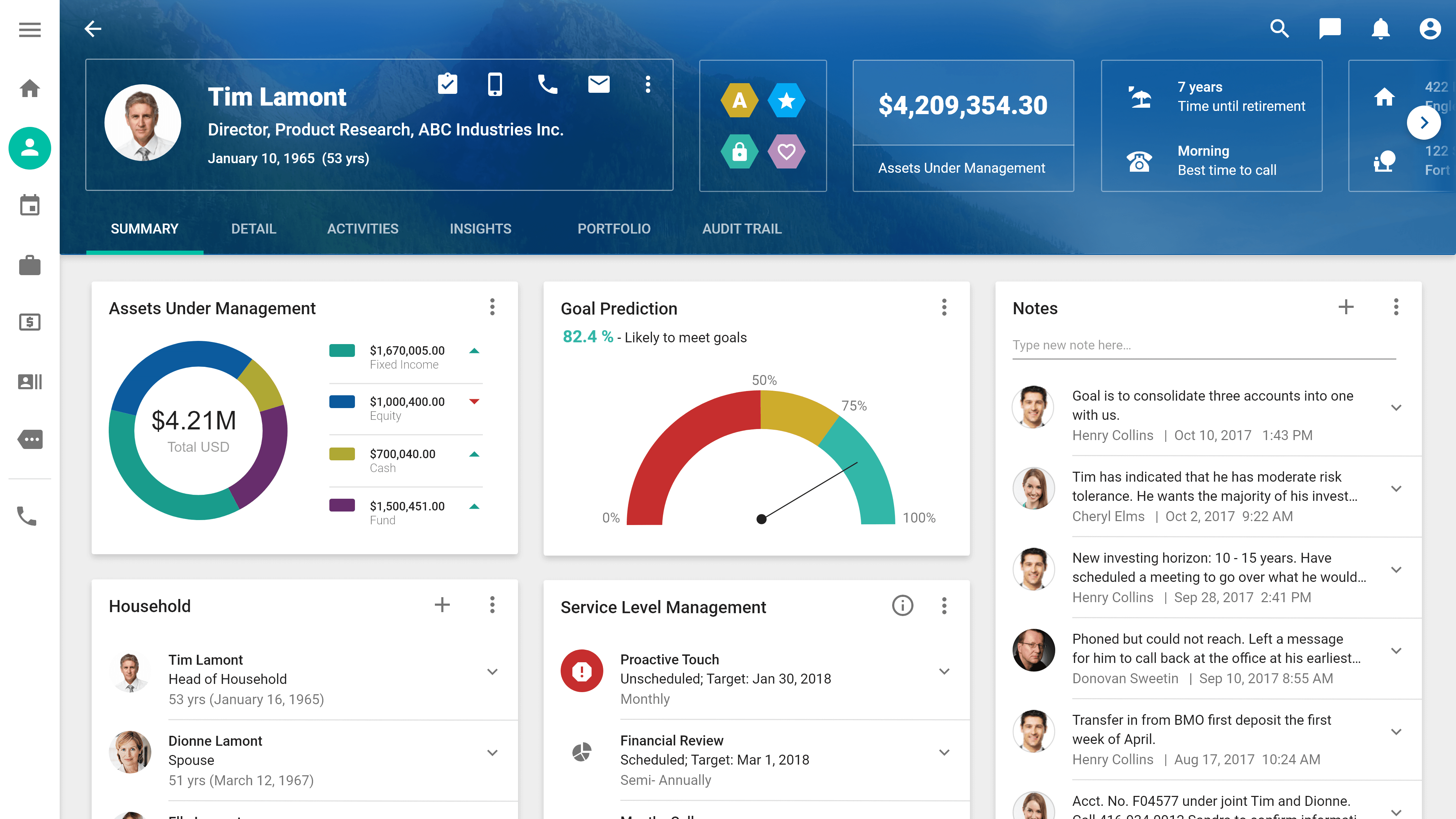

By centralizing client data, a CRM provides a comprehensive view of each client’s investment portfolio, risk tolerance, and communication history. This allows investment managers to tailor investment strategies, make informed decisions, and provide personalized service.

Integration with Other Tools, Crm for investment

Integration with other investment management tools, such as portfolio management systems and market data providers, further enhances CRM’s capabilities. This seamless data flow eliminates manual data entry, reduces errors, and provides real-time insights for informed decision-making.

Key Features of a CRM for Investment Management

A robust CRM for investment management should possess a comprehensive suite of features that cater to the specific needs of this industry. These features enhance collaboration, streamline workflows, and provide valuable insights, enabling investment managers to make informed decisions and achieve optimal results.

When selecting a CRM, it’s crucial to consider the following key features:

Contact Management

Effective contact management is paramount in investment management. A CRM should provide robust capabilities for storing, organizing, and managing contacts, including individual investors, family offices, and institutional clients. Advanced features like contact segmentation, custom fields, and relationship mapping enable investment managers to tailor their outreach and marketing efforts.

Opportunity Management

A CRM streamlines the opportunity management process by providing a centralized platform to track and manage potential investment opportunities. Features such as lead scoring, deal pipelines, and automated workflows help investment managers prioritize prospects, nurture relationships, and convert leads into clients.

Investment Tracking

Investment tracking is essential for monitoring the performance of investment portfolios. A CRM with integrated investment tracking capabilities allows investment managers to track asset allocation, returns, and risk exposure in real-time. This data provides valuable insights for making informed investment decisions and managing client portfolios effectively.

Reporting and Analytics

Robust reporting and analytics capabilities are crucial for investment managers to gain insights into their performance and make data-driven decisions. A CRM should provide customizable reports and dashboards that track key metrics such as sales performance, client acquisition costs, and investment returns.

This data enables investment managers to identify trends, measure progress, and make adjustments to their strategies.

Customization and Flexibility

Customization and flexibility are essential for a CRM to adapt to the unique needs of different investment management firms. A CRM should allow for the creation of custom fields, workflows, and reports to align with specific business processes. This flexibility ensures that the CRM can be tailored to meet the evolving needs of the firm and its clients.

Integration with Other Systems

Integration with other systems is crucial for a CRM to function as a central hub for investment management activities. Seamless integration with accounting systems, portfolio management platforms, and marketing automation tools enables data sharing and eliminates the need for manual data entry.

This integration streamlines workflows and improves efficiency.

Comparison of CRM Systems Based on Key Features

The following table compares different CRM systems based on their key features:

| CRM System | Contact Management | Opportunity Management | Investment Tracking | Reporting and Analytics | Customization and Flexibility | Integration with Other Systems |

|---|---|---|---|---|---|---|

| CRM System A | Excellent | Good | Average | Good | Average | Good |

| CRM System B | Good | Excellent | Good | Excellent | Good | Excellent |

| CRM System C | Average | Good | Excellent | Average | Excellent | Average |

Importance of Customization and Flexibility in a CRM for Investment Management

Customization and flexibility are critical for a CRM to meet the unique requirements of investment management firms. The ability to tailor the CRM to specific business processes, workflows, and reporting needs ensures that the system aligns with the firm’s investment strategy and client management approach.

A flexible CRM enables investment managers to adapt to changing market conditions and evolving client expectations. It allows for the creation of custom fields to capture industry-specific data, the automation of complex workflows to streamline operations, and the generation of customized reports to track key performance indicators.

By providing customization and flexibility, a CRM empowers investment managers to optimize their operations, enhance client relationships, and achieve superior investment outcomes.

Implementation and Best Practices for CRM in Investment Management

Implementing a CRM for investment management involves several key steps:

Define goals and objectives

Clearly Artikel the desired outcomes and how the CRM will contribute to achieving them.

Choose a CRM platform

Select a platform that aligns with the specific needs and requirements of the investment management firm.

Data migration and integration

Import relevant data from existing systems and ensure seamless integration with other software.

Customization and configuration

Tailor the CRM to fit the unique processes and workflows of the firm.

User training and adoption

Provide comprehensive training to ensure users understand and effectively utilize the CRM.

Best Practices for Maximizing CRM Effectiveness

To maximize the effectiveness of a CRM in investment management, consider the following best practices:

Centralize client data

Consolidate all relevant client information in a single, accessible location.

Automate workflows

Streamline processes such as lead generation, opportunity tracking, and client communication.

Utilize reporting and analytics

Track key performance indicators (KPIs) and generate reports to monitor progress and identify areas for improvement.

Foster user adoption

Encourage active participation and provide ongoing support to ensure the CRM is fully utilized.

Case Studies of Successful CRM Implementations

Case Study 1

A leading asset management firm implemented a CRM to improve client relationship management. The CRM enabled the firm to centralize client data, automate marketing campaigns, and track client interactions. This resulted in a significant increase in client satisfaction and retention.

Case Study 2

A private equity firm used a CRM to streamline its investment process. The CRM allowed the firm to manage deal flow, track due diligence, and communicate with investors. This resulted in increased efficiency and improved deal closing rates.

Challenges and Considerations for CRM in Investment Management

Implementing and using a CRM in investment management presents several challenges. Understanding these challenges and addressing them effectively is crucial for successful CRM implementation and adoption.

Additionally, the investment management industry is heavily regulated, which imposes specific compliance considerations that impact CRM usage. It is essential to be aware of these regulations and ensure compliance to avoid potential legal or reputational risks.

Challenges Associated with Implementing and Using a CRM

- Data Integration:Integrating data from multiple sources, such as portfolio management systems, trading platforms, and client relationship management (CRM) systems, can be complex and time-consuming.

- Data Quality:Ensuring the accuracy and completeness of data in the CRM is crucial for effective decision-making. Poor data quality can lead to inaccurate insights and suboptimal investment decisions.

- User Adoption:Encouraging investment professionals to adopt and use the CRM effectively can be challenging due to resistance to change or perceived complexity of the system.

- Customization:Customizing the CRM to meet the specific needs of investment management firms can be complex and resource-intensive, requiring technical expertise and a deep understanding of the industry.

Regulatory and Compliance Considerations

- Data Privacy and Security:Investment management firms are responsible for protecting client data and ensuring compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

- Know Your Customer (KYC) and Anti-Money Laundering (AML):CRMs can facilitate KYC and AML processes by capturing and storing client information and transaction data. Firms must ensure that their CRM is compliant with these regulations.

- Market Abuse Regulation (MAR):CRMs can be used to track and monitor communications with clients and potential investors. Firms must ensure that their CRM usage complies with MAR to prevent insider trading and market manipulation.

Recommendations for Addressing Challenges and Ensuring Compliance

- Establish a Clear Implementation Plan:Develop a comprehensive plan that Artikels the scope of the CRM implementation, timelines, and resource allocation.

- Focus on Data Quality:Implement data quality processes and tools to ensure the accuracy and completeness of data in the CRM.

- Promote User Adoption:Provide training, support, and incentives to encourage investment professionals to use the CRM effectively.

- Customize with Care:Customize the CRM to meet specific needs, but avoid over-customization that can lead to complexity and maintenance challenges.

- Stay Up-to-Date with Regulations:Regularly review and update CRM usage to ensure compliance with evolving regulatory requirements.

- Seek Professional Guidance:Consider consulting with experts in investment management CRM implementation and regulatory compliance to ensure best practices are followed.

Future Trends and Innovations in CRM for Investment Management

The future of CRM for investment management holds immense promise, with emerging technologies and innovations poised to revolutionize the way investment firms manage their client relationships and drive growth. Artificial intelligence (AI) and machine learning (ML) are at the forefront of these advancements, transforming CRM capabilities and unlocking new possibilities.

AI and ML in CRM

- Automated Lead Generation and Qualification:AI-powered algorithms can sift through vast amounts of data to identify potential leads and qualify them based on pre-defined criteria, saving time and effort for investment managers.

- Personalized Client Engagement:ML models can analyze client interactions, preferences, and behavior to create personalized engagement strategies, tailoring communications and offerings to meet individual needs.

- Predictive Analytics:AI algorithms can analyze historical data and identify patterns to predict client behavior, enabling investment managers to anticipate needs and proactively address them.

Other Innovations

Beyond AI and ML, other innovations are also shaping the future of CRM for investment management:

- Cloud-Based CRM:Cloud-based CRM systems offer increased flexibility, scalability, and accessibility, allowing investment firms to manage client relationships from anywhere, anytime.

- Integration with Other Systems:Modern CRM systems integrate seamlessly with other business applications, such as portfolio management and accounting software, streamlining workflows and improving data accuracy.

- Mobility:Mobile CRM apps empower investment managers to stay connected with clients and access critical information on the go, enhancing productivity and responsiveness.

Final Thoughts

In conclusion, CRM for investment management is an essential tool for investment firms seeking to elevate their client service, optimize operations, and achieve exceptional investment results. By embracing the transformative power of CRM technology, investment professionals can unlock new levels of efficiency, strengthen client relationships, and drive informed investment decisions.

As the industry continues to evolve, CRM will undoubtedly remain at the forefront of innovation, empowering investment firms to navigate complex markets and achieve long-term success.

FAQ Insights

What are the key benefits of using CRM for investment management?

CRM for investment management offers numerous benefits, including improved client relationship management, streamlined processes, enhanced communication, and data-driven insights that support better investment decisions.

What are the essential features to look for in a CRM for investment management?

Key features of a robust CRM for investment management include client management tools, portfolio tracking, performance reporting, document management, and integration with other investment platforms.

How can investment firms ensure successful CRM implementation?

Successful CRM implementation requires careful planning, involving stakeholders, defining clear goals, providing proper training, and ongoing monitoring and evaluation to optimize effectiveness.